Leveraging Over 70 Years of Energy Technology Experience in Gas, Oil and LNG to Establish Safe Hydrogen Infrastructure.

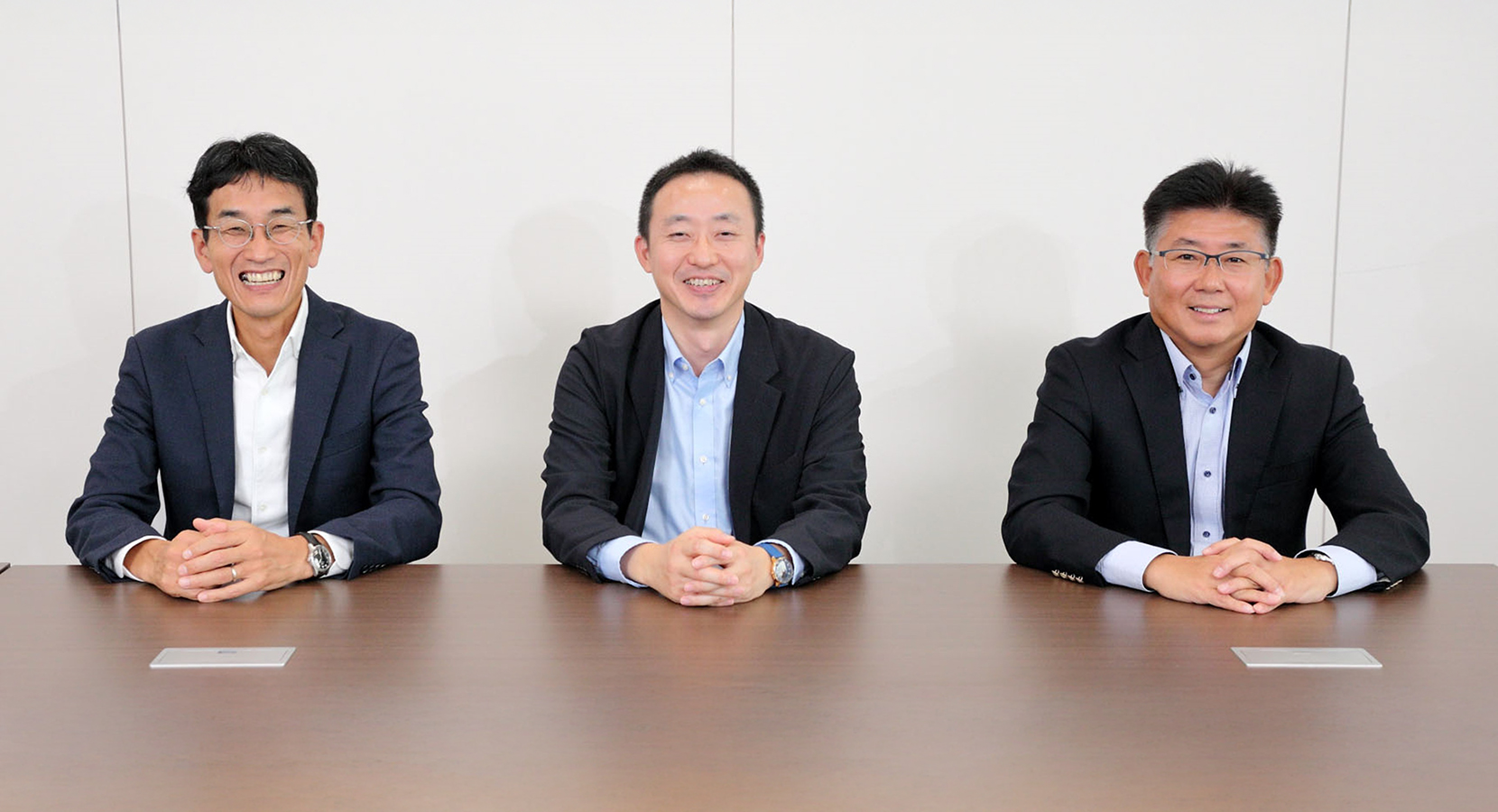

──What do you consider to be Chiyoda's strengths in the hydrogen business?

Ito

Our strengths in the hydrogen business lie in the knowledge and expertise in oil, gas/LNG and renewable energy accumulated over 70 years since our founding. Our experience in handling large amounts of hydrogen stems from, as one example, the Engineering, Procurement, and Construction (EPC) of plants that produce synthetic fuels using hydrogen and CO₂ as raw materials, enabling us to apply production technology cultivated over the years.

Inoue

We will apply our hydrogen production and utilization technological expertise and experience to meet the anticipated exponential growth in demand for clean hydrogen. Hydrogen, ammonia and natural gas have distinct characteristics and require different approaches to safety management. Drawing on our years of experience, we can propose appropriate facilities and solutions for each of these elements within the entire supply chain.

Morikami

Safety is our company’s core value. Natural gas is odorless, colorless and tasteless and we employ a deliberate process to add odor to detect leaks. Peak quality standards are applied to ensure high sealing performance for hydrogen storage containers and cylinders. In the event of a leak, hydrogen facilities are equipped with exhaust vents and fans to rapidly disperse hydrogen into the atmosphere and prevent accumulation in an enclosed space. Our commitment to safety is pivotal to establishing hydrogen infrastructure.

Hydrogen Market Expansion to 2030.

──Can you please provide an outlook on the future of the hydrogen business?

Inoue

There are many challenges still to be addressed. Some hydrogen technologies and equipment required to establish a fully functioning supply chain, including infrastructure development, and are yet to be established and legal and regulatory frameworks are needed to enable the use of hydrogen in new applications.

Significant hydrogen developments continue however, including the Japanese government's ‘Hydrogen Basic Strategy’ announced in 2023 that provides clear numerical targets for direction and scale. The strategy includes expanding consumption of hydrogen to approximately 3 million tons per year by 2030 and 20 million tons per year by 2050, and establishes a new target of approximately 12 million tons per year (including ammonia) for 2040. A commercially viable domestic hydrogen supply chain is pivotal to achieving these targets and we are accelerating discussions with potential customers and partners, focusing on accelerating technological developments, reducing costs and increasing efficiency.

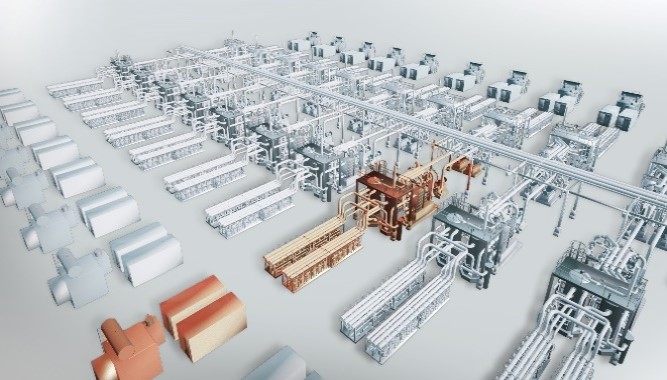

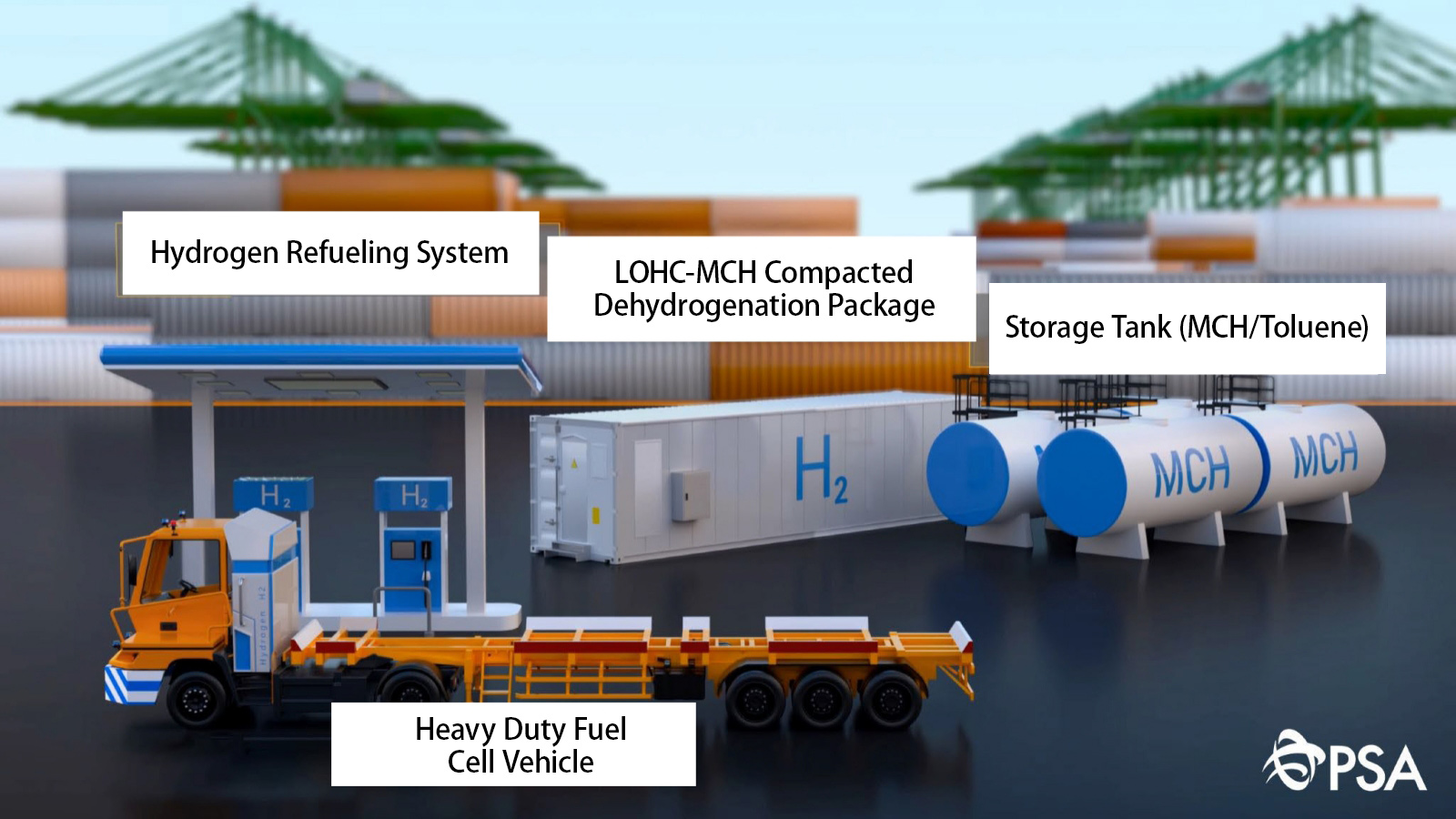

We are expanding our LOHC-MCH (SPERA Hydrogen System) to achieve commercial goals in the 2020s, consolidating our position in the expanding hydrogen market beyond 2030.

──Do you have any specific plans or measures in place?

Inoue

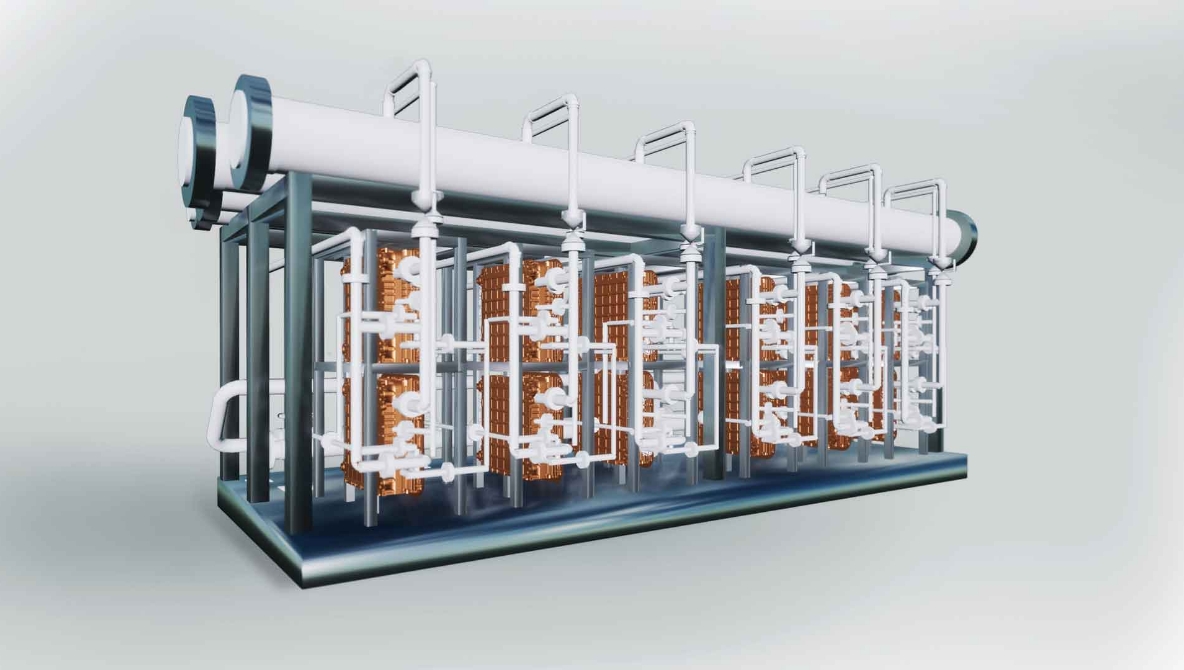

/en/media/assets/221222_e_4.pdfHydrogen production will be strengthened by water electrolysis systems to be installed in Toyota Motor Corporation's headquarters factory hydrogen park in FY2025, and enlarged to 20MW for demonstration and development purposes.

The initial hydrogen production capacity of the development project with Hazer Pty Ltd. and Chubu Electric Power Co. is projected to range from 2,500 tons to 10,000 tons per year, ultimately rising to 50,000 tons to 100,000 tons per year.

Europe is an advanced region for hydrogen and we are involved in a hydrogen highway project to transport hydrogen from Scotland to Rotterdam using our LOHC-MCH technology.

Press Release

Ito

We have completed a 1 Barrel per Day (BD) capacity test plant for the production of synthetic fuels for ENEOS Corporation, supporting hydrogen utilization by establishing early-stage technology for the production of synthetic fuels using hydrogen and CO2 as raw materials. Operation cmmenced in September 2024.

We are also executing the EPC phase of a 400 Nm3-CO2/h production capacity methanation test plant, one of the largest facilities in the world, for INPEX Corporation, involving synthesizing methane from hydrogen and CO2. Methanation technology is crucial for gas decarbonization.

──What about collaboration with universities and research institutions?

Ito

We continue to explore collaboration opportunities with customers and partners to commercialize a hydrogen supply chain, including renewable energy companies, traders, construction companies and end-users.

Inoue

We are also actively engaging in discussions with new partners as we create new markets, and there are cases where previous customers have evolved into partners.

Morikami

One example is the development project for catalysts to extract hydrogen from ammonia, where we are working in collaboration with JERA Co., Inc, a previous customer and Nippon Shokubai Co., Ltd., a new partner.

Inoue

We are also receiving inquiries from venture companies, universities and research institutions who lack the expertise to commercialize core technologies they have developed, and approach our company, an integrated engineering organization, for support.

Ito

Our newly established ‘Value Innovation Department’ harvests information on startup businesses and new technologies and we take the initiative of approaching promising companies to engage in active information exchange.

Inoue

We are aiming to leverage the expertise of Toyota Motor Corporation as an industrial product manufacturer in our ‘large-scale water electrolysis system’ collaboration project, in combination with our expertise as a facility provider, to continue contributing to the realization of a hydrogen society and hope to expand such initiatives in the future.

Reducing Hydrogen Supply Costs

──Finally, there is a need to reduce costs to successfully realize a hydrogen society. Can you please share such initiatives?

Ito

Hydrogen is essential for achieving a decarbonized society and we will continue focusing on technological innovation and improving our EPC capabilities to reduce costs to acceptable levels for end-users.

Inoue

Cost reductions are essential and the Japanese government's ‘Hydrogen Basic Strategy’ establishes targets for hydrogen supply costs, aiming to reduce the current cost of 100 yen/Nm3 to 30 yen/Nm3 by 2030 and 20 yen/Nm3 by 2050.

Chiyoda’s technology optimizes the entire hydrogen supply chain, reducing the costs of hydrogen supply.