Chioyoda announced "Review of the Medium-Term Management Plan (2017-2020) Vision for Revitalization" on November 9, 2018. Please refer to here for detail.

Overview of the Medium-Term Management Plan

Structural reform

Create a solid management base for future growth

Growth strategy

Expand business fields and transform business model looking ahead 10 years

- CHIYODA’s core value

Technological strength and project execution capabilities that achieve

harmony between Energy and Environment -

- EPC: Engineering, Procurement and Construction

Structural reform

- 1. Further strengthen risk

management capabilities - 2. Increase basic earnings

strength and enhance

resilience to downturns - 3. Further expand human

resource base

Goals

- Establish a corporate structure that promotes sustainable growth, by turning technological superiority to improved earnings (FY2018)

- Thoroughly adhere to committed profitability to ensure achievement of FY2020 quantitative targets (throughout the MTMP period)

1Strengthen structure for execution and profitability management of EPC projects on consolidated basis

- Optimize execution structure on a consolidated basis

- Redefine and rebuild project management and control process

- Further enhance profitability management and accuracy, including sharing of project knowledge and expertize, at companywide level

- Make operational flows more efficient

2Establish structure for expansion of business fields and transformation of business model

- Strengthen intelligence over external environment, market trends, and business and technological trends

- Strengthen corporate structure to identify and analyze business risks, execution, management and control at asset holding business

- Ascertain time scale and financial targets for commercialization of proprietary technologies

- Establish corporate structure, including utilization of external human resources necessary for developing Growth Strategy

Goals

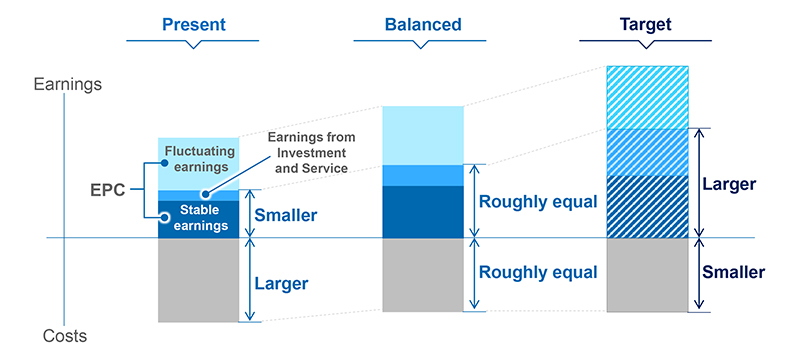

- Expand basic earnings by developing technological strength, project execution capabilities and cost competitiveness (throughout the MTMP period)

- Reduce consolidated fixed costs with the aim of balancing basic earnings and costs (FY2020)

- Redefine domestic and global operational structure (FY2018)

- Basic earnings: Stable EPC earnings + earnings from Investment and Service

Goals

- Develop technological strength and project execution capabilities (throughout the MTMP period)

- Realign the HR development system with medium- to long-term outlook (FY2018)

- Implement optimal assignment of human resources for continuous earnings growth (throughout the MTMP period)

Human resource utilization

- Proactively reassign human resources to growth fields

- Establish companywide structure to promote optimal assignment of human resources

- Strengthen global HR system to achieve human resource mobility within the group

- Promote further diversity and expand the system to enable various work styles

Human resource development

- Establish structure for medium- to long-term human resource development

- Develop PKPs / PEs*1 by producing OJT*2 opportunities based on proactive execution of mid-sized projects

- Continue the PKP development program to expand EPC execution capacity

- Improve the development system for managerial talent

Enhance potential of all employees

Foster a stronger corporate foundation with high loyalty and willingness to pursue new challenges

- 1. PKP: Project Key Personnel / PE: Project Engineer

- 2. OJT: On-the-job Training

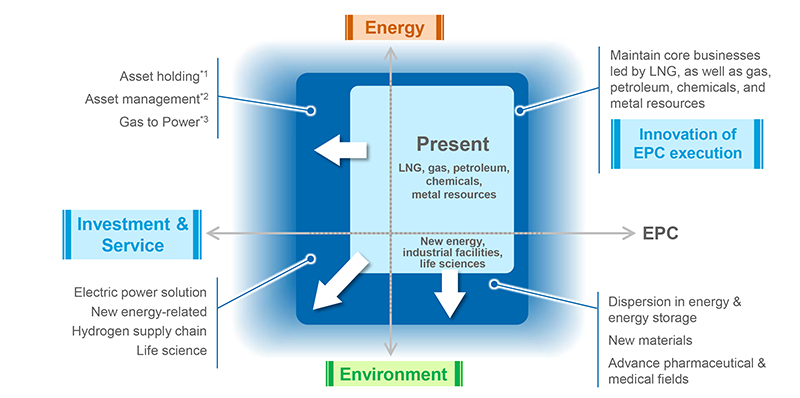

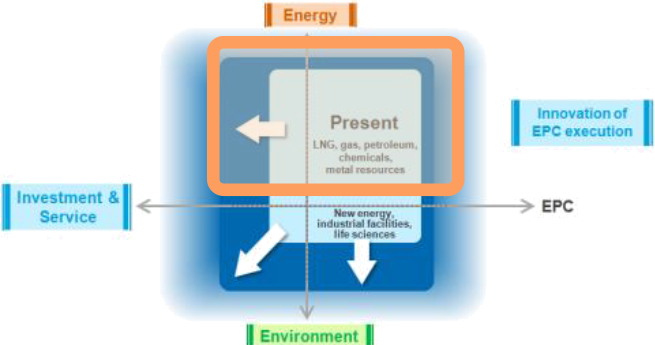

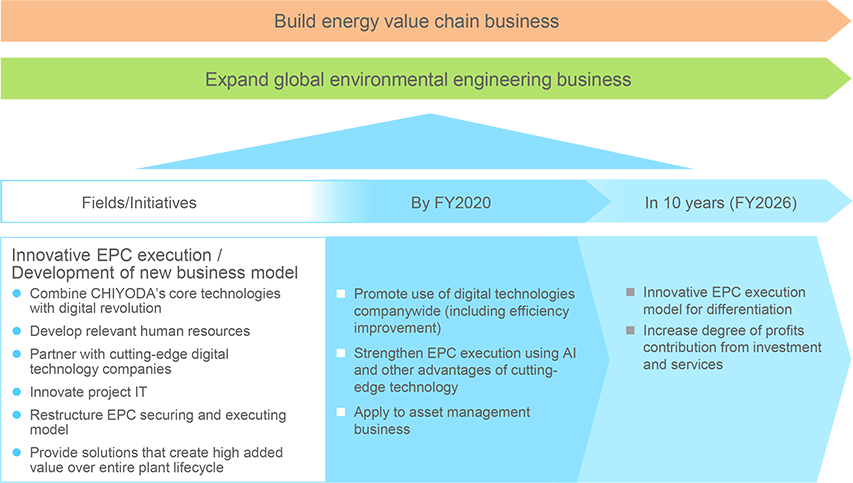

Growth Strategy

Expansion of business fields and transformation of business model

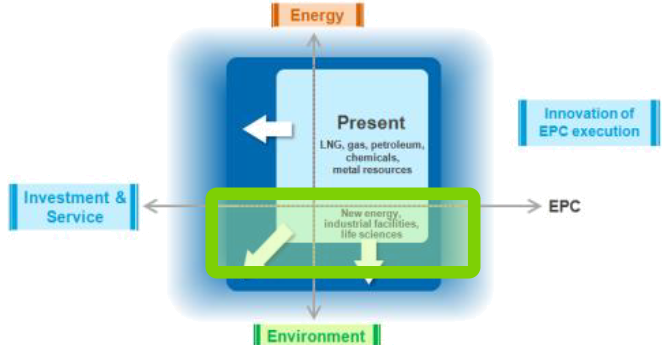

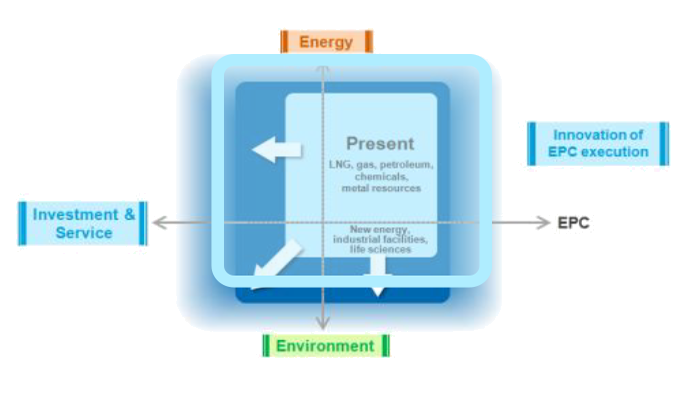

Chiyoda Group expands two key business fields of Energy and Environment (vertical axis below) and aims to innovate EPC execution and diversify our business into investment and service areas by utilizing innovative digital technologies (horizontal axis below).

- 1. Asset holding: Businesses that gain earnings from holding and managing assets like floater (floating facilities) and onshore plants

- 2. Asset management: Businesses that gain earnings by providing various technological services to holders of assets

- 3. Gas to Power: An integrated business of LNG liquefaction, LNG regasification, and power generation

- 1. Build energy

value chain business - 2. Expand global

environmental engineering

business - 3. Develop new

business

model

for a digital society

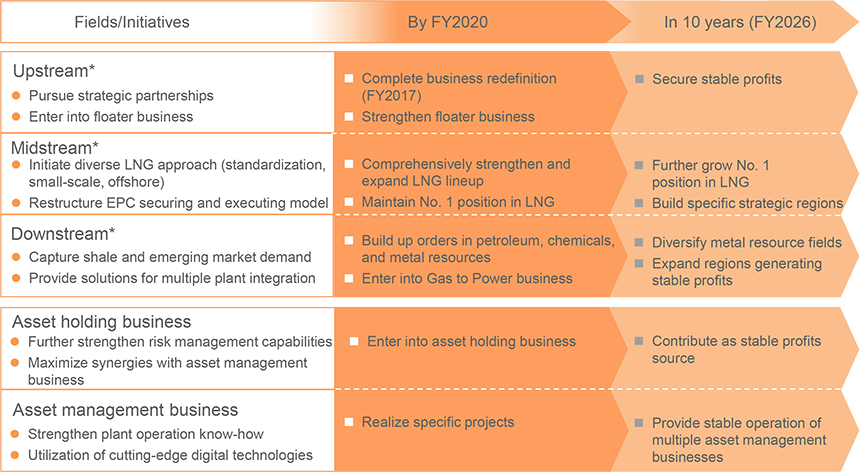

In Upstream field, Chiyoda Group enters into floater business, in Midstream field, it initiates diverse LNG approach (standardization, small-scale, offshore), and in downstream field, it captures shale and emerging market demand and builds up orders in petroleum, chemicals and metal resources. Further, it aims to enter into Gas to Power business. While, it enters into asset holding business and asset management business through realization of specific project.

- Above business field classifications are as per CHIYODA’s standards

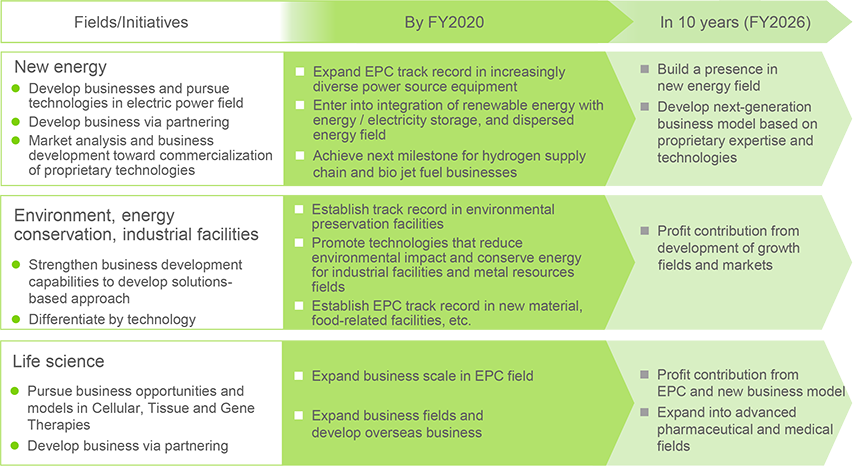

In addition to expansion and build up of EPC experience in each business field, in new energy field, Chiyoda Group enters into integration of renewable energy with energy / electricity storage, and dispersed energy field. In environment, energy conservation, industrial facilities, it promotes technologies that reduce environmental impact and conserve energy for industrial facilities and metal resources field. In life science field, it pursues business opportunities and models in Cellular, Tissue and Gene Therapies.

Chiyoda Group combines its technological strength and project execution capability which are its core value and engages in innovative EPC execution and development of new business model.

Through such activities, Chiyoda Group achieves two main business strategies such as "Build energy value chain business" and "Expand global environmental engineering business".

Through such activities, Chiyoda Group achieves two main business strategies such as "Build energy value chain business" and "Expand global environmental engineering business".

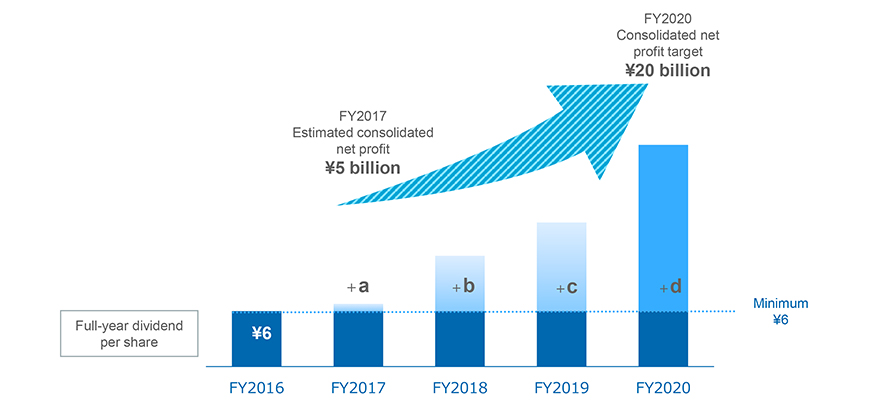

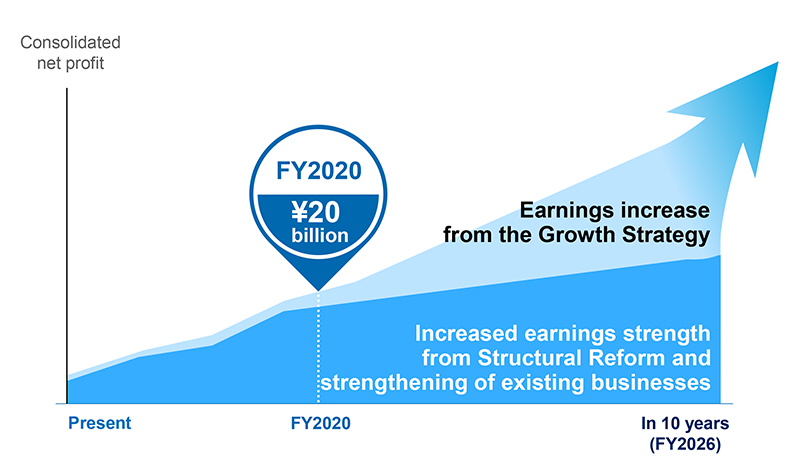

Quantitative Targets

Chiyoda Group recognizes that FY2020 is milestone of Growth Strategy looking ahead 10 years and aims to achieve consolidated net profit of JPY 20 billion with double-digit ROE by increased earnings strength from Structural Reform and strengthening of existing businesses.

Consolidated net profit

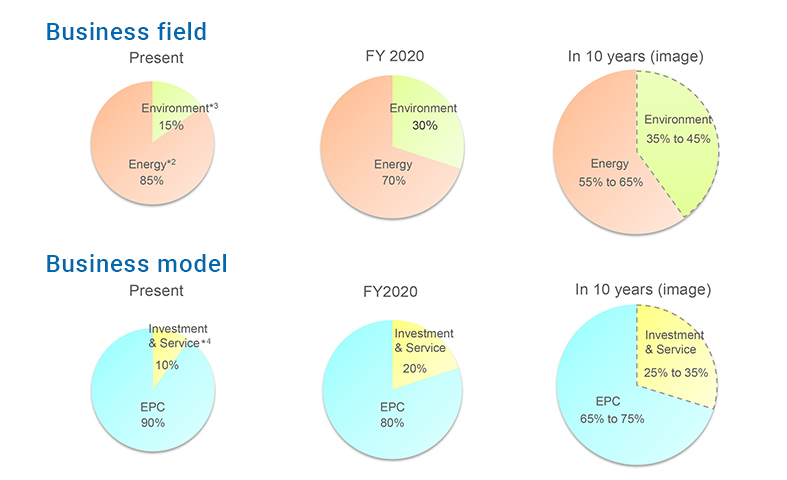

Earnings*1 portfolio

- 1. Earnings: Gross profit on orders and profit through Investment & Services

- 2. “Energy” includes LNG, gas, petroleum, and chemicals, as well as metal resources and Gas to Power

- 3. “Environment” includes new energy (such as renewable energy, energy storage, and hydrogen), industrial facilities (such as environmental preservation facilities, the new materials and food-related facilities), and life science (such as pharmaceuticals and medicine)

- 4. “Investment & Service” includes business investment and operation, consulting, and various construction and technological services for existing facilities

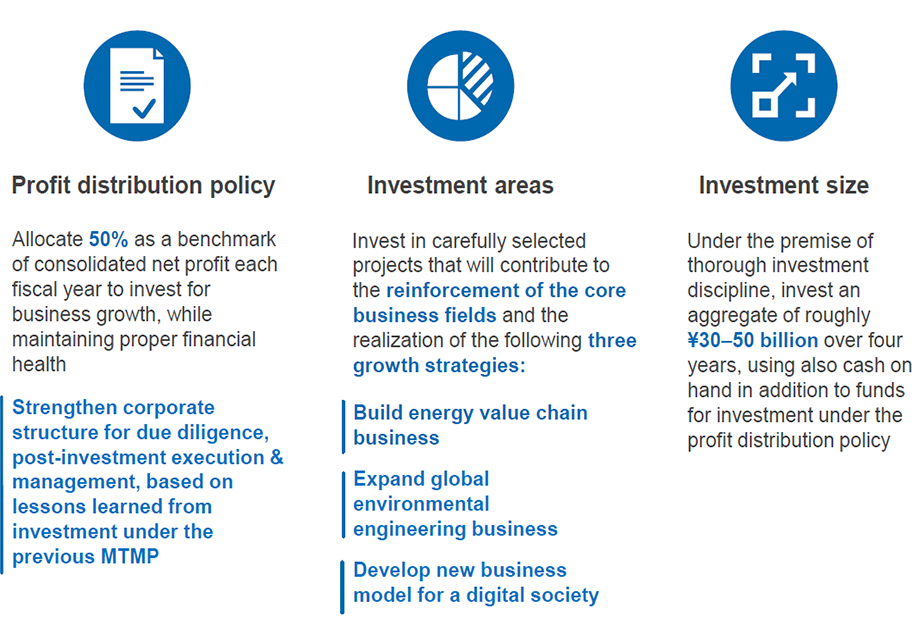

Investment Strategy

Policy on Returns to Shareholders

Chiyoda Group sets minimum full-year dividend of JPY 6 per share and determines dividend amount each fiscal year in consideration of progress under Growth Strategy and the Investment Strategy together with operating environment. And, it sets consolidated dividend payout ration of at least 30% during the MTMP period.